WE RECOMMEND THE

Foundations Package

Because where you are in business deserves a strategy that matches it

You’ve built a business that supports you, your clients, your family.

But when it comes to taxes, it still feels like you’re dropping the ball even when you’re not.

You’re filing on time, tracking expenses, doing “everything right”… and yet, tax season still comes with that sinking feeling of am I missing something? And a 5-figure bill you didn’t plan for.

That’s where the Foundations Package comes in.

It’s a done-for-you strategy that helps you stay organized, plan ahead, and finally understand what’s going on behind your numbers — so you can stop reacting and start feeling confident about where your money’s going.

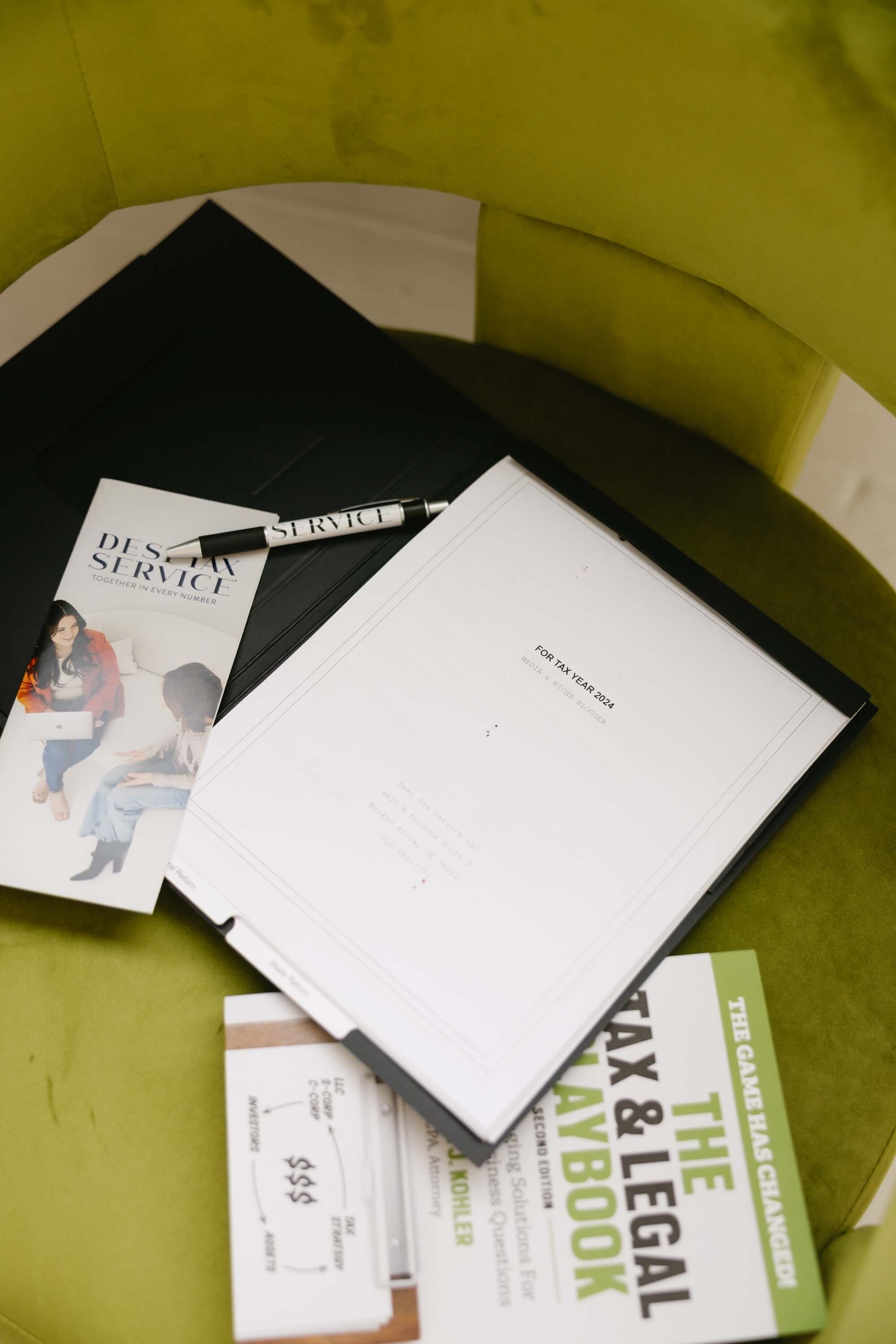

At Desi Tax Service®, we don’t just prepare returns. We help you make sense of them — so every decision you make, from payroll to profit, actually supports the business you’re building. We even partner with your bookkeeper to make sure they can advise you between meetings.

Let’s make your taxes make sense.

I know what it’s like to feel lost in the numbers.

When I first started helping business owners with their books and returns, I saw the same pattern over and over again—smart, hardworking people doing their best, but still feeling like taxes were this constant, expensive burden.

And honestly? It’s not their fault.

No one teaches you how to run payroll and plan for quarterly taxes and track deductions in a way that actually helps you come out ahead.

That’s why I built my firm differently.

At Desi Tax Service®, we don’t just prepare returns and call it a day. I help you understand what’s happening behind the scenes—so you can make real, confident decisions for your business and your life.

Because once you understand your numbers, everything else gets lighter—your workload, your stress, even the way you plan your next move.

You don’t need to know all the tax laws. You just need a partner who does.

what we offer

THE Foundations Package

THE OVERVIEW

+ Phone and Chat Support

+ Twice a Year Check-Ins

+ Tax Preparation

+ Tax Savings Plan

+ Tax Deadline Reminders

+ Tax Notice Monitoring

+ Entity Compliance Monitoring

+ Payroll Compliance Monitoring

+ Secure Client Portal

+ Done-For-You Implementation

+ Optional: Advanced Strategy Add-On

THE INVESTMENT

Starting at $3,450

A payment plan option of six monthly installments is available upon request. This plan includes an upfront financing fee of $250, due with first payment.*

Our fees for services are tax-deductible

*Fees for service will vary based on the complexity required to complete the tax return.

*6-month commitment required

After our first year together, you’ll be placed on our tax maintenance package at a rate of $2,550.

THE DETAILS

phone and chat support

You'll never have to wonder if reaching out will come with a surprise bill—that's not how we do things here. Our team is here for you during tax season and the rest of the year. You'll have secure chat access right from your phone so you can get quick answers when you need them.

Need something more personal? You can grab a spot on my calendar for a call using our scheduling link. To make sure every client gets the attention they deserve, phone call spots are limited each week. My promise is simple: prompt, reliable support that makes you feel taken care of every step of the way.

Interested in advanced ways to reduce your tax liability?

You may be eligible for a one-time Advanced Tax Strategy Add-On.

These powerful strategies are ideal for clients in a position to implement a high-impact move, such as:

Electing S-Corporation status

Setting up a Accountable Plan

Leveraging a board of advisors Strategy

Or other advanced, IRS-approved options

Because these strategies are highly customized, they’re only available to clients who meet specific criteria. If you’re a good fit, we’ll walk you through the process and handle the implementation—start to finish.

Please note: Advanced strategies are billed separately, starting at $550 per strategy.

INTERESTED IN LEARNING MORE?

Let us know during your discovery call, and we’ll determine whether you’re a good fit for an advanced strategy.

Our services were built for business owners who are done trying to figure it all out alone.

You’ve outgrown the “file and forget” approach and you’re ready for something steadier, smarter, and more supportive.

This package is for you if

the small business tax service process

Desi’s Year-Round Route

step 01

FIND YOUR FIT.

Take the 2-Minute Quiz to find the service package that best fits your business.

step 02 (you are here)

APPLY ONLINE.

After reviewing your recommended package, complete the Client Application Form so we can make sure we’re the right fit.

step 03

GET STARTED.

Once your account is active, we’ll schedule a 20-minute discovery call to review next steps and officially kick off your tax savings plan.

“I have anxiety every year when it comes to getting my taxes done. Not this year. Desi was really great at explaining every detail. She is nice and professional and patient. I am so grateful Desi completed my taxes. You can trust Desi to do your taxes correctly. Her office staff is really nice and professional as well. I will go back.”

- Scott

Certifications

We stay up to date on payroll software and accounting software, like our go-to Gusto and Quickbooks

Ready to Finally Feel in Control of Your Taxes?

You’ve spent enough time guessing, stressing, and hoping it all adds up.

It’s time for strategy that matches your effort — and a partner who sees the full picture.

At Desi Tax Service®, we don’t just prepare returns. We help you build confidence in your numbers, peace of mind in your business, and a plan that actually works.

because the goal isn’t just to save on taxes — it’s to build something that lasts.

Informed decisions

but better

All the tax and bookkeeping skills that school never taught you. Sign up for tax tips, bookkeeping advice, and general biz knowledge to keep you growing.