Case Study: Realtor Saved $9,811

Amanda — name changed for privacy — has been a successful realtor for a little over three years. When she was not showing houses to potential buyers, she was looking for her own dream home and spending time on her favorite hobby, motorcycle riding.

Amanda came to Desi Tax after filing a tax return with a popular tax software company. During her filing, Amanda felt that something was off and that she owed too much in taxes.

Her suspicions were confirmed just a few weeks after filing, when she got TWO separate letters from the IRS, claiming that she owed an additional amount totaling a whopping $7,500.

At that point, Amanda owed almost a third of her business profits in taxes. She knew that something wasn’t right and reached out to Desi Tax.

How Desi Tax Helped a Small Business Owner Go from Owning $15,695 to Paying Just $5,884 in Taxes

At a Glance

Before

At the time of the filing, Amanda was looking to buy a home and was going to use her business income to apply for home loans.

The tax filing software that Amanda used only allowed her to claim $120 as a standard/itemized deduction for head of household.

Head of household filing status is supposed to offer more generous tax brackets and standard deduction than filing single. In fact, the standard deduction for the head of household was $19,400 for 2022. Amanda thought that she should’ve been able to claim more, but the software didn’t give her any other options.

At the time of filing, Amanda’s AGI (Adjusted Gross Income) was $47,555, which is what loan officers typically look for when approving for home loans.

Amanda also claimed only $13 in business expenses. She was previously advised not to claim any business expenses in order to qualify for home loans and, as a result, her taxable income was $37,950.

Amanda owed $8,195 in taxes at the time of filing. And then, a few weeks after, she was contacted by the IRS and told that she actually owed an additional $7,500.

In this nightmare of a situation, Amanda owed a total of $15,695 in taxes, which accounted for 15.3% of her business profits.

She felt frustrated and tired of trying to navigate her numbers alone. Amanda didn’t want to pay even more money to the IRS and quickly got in touch with Desi Tax.

Plan of Action

After a deep dive into Amanda’s business profits and the recent tax return, it became apparent that she was overpaying in taxes.

Desi Tax’s goal was to adjust Amanda’s tax return to reduce the amount that she owed while preserving her eligibility for home loans.

To do that, Desi Tax needed to amend her original tax return with a new standard head of household deduction, AGI, taxable income, and business expenses.

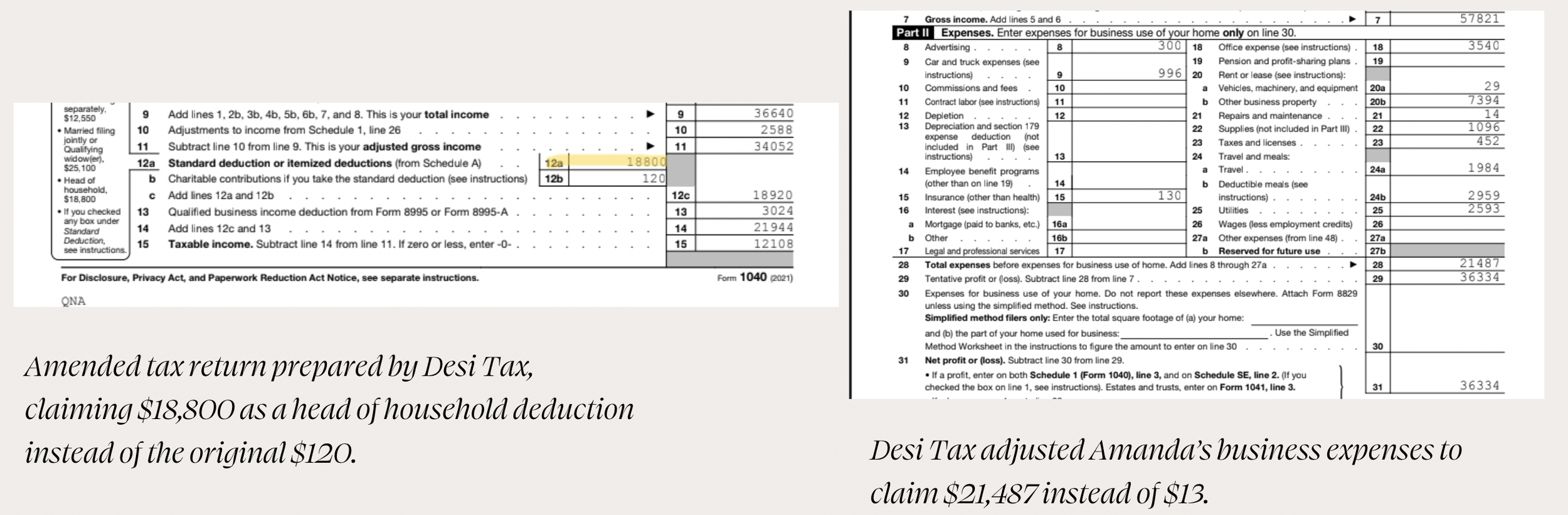

The first thing the Desi Tax team did was adjust Amanda’s standard deduction for head of household, claiming $18,800 instead of $120.

This resulted in a new AGI of $34,052, which still qualified for home loans.

→ Even though this amount was less than what Amanda had originally reported, it ended up being more beneficial to her in the long run. It allowed her to show steady business growth without overpaying in self-employment taxes.

Desi Tax also adjusted Amanda’s tax return to claim $21,487 in business expenses, a big increase from the original $13.

The Results

The amended tax return Desi Tax filed for Amanda claimed $12,108 in taxable income, which lowered the amount of tax she owed to $5,884 instead of the original $15,695.

Then Desi Tax requested a refund from the IRS for the total amount of $9,811, which was approved.

After working together, Amanda was able to:

✅ Save $9,811, which she used to buy a new motorcycle and put toward a down payment

✅ Qualify for home loans, even with adjusted AGI and claiming $21,487 in business expenses

✅ Spend more time on her business instead of trying to navigate her taxes alone

✅ Start feeling confident in her tax strategy

Filing Taxes as a Business Owner: What You Should Know

To avoid stress and costly mistakes when it comes to your taxes as a small business owner or entrepreneur, consider the following tips:

If you decide to use DIY tax software, always double check your options to make sure the decisions you’re making are strategic & profitable.

Speak with professionals about big financial decisions, such as purchasing a home, instead of taking advice from friends, family, or coworkers.

Work with a tax professional to create a custom tax strategy that serves your goals and takes advantage of all the benefits and write-offs that you qualify for.

Outsourcing their tax & bookkeeping to a professional can be a game-changer for small business owners and entrepreneurs.

If you want to be our next success story, learn more about Desi Tax services and inquire about working with us!